tax benefit rule calculation

Its main principle is that if a taxpayer recovers a sum of money that should have been paid in the past they must. The rule is promulgated by the Internal Revenue Service.

Taxation Of Social Security Benefits Mn House Research

Individual Income Tax Return or Form 1040-SR US.

. However if total tax increases by any amount a tax benefit was received. Personal use is any use of the vehicle other than use in your trade or business. Calculation of net profit of self-employed earners.

In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the new SALT limit. 10000 250 1800 1500 2500 16050 total deductible payments for year 1 16050 22 3531 annual deduction for year 1 3531 12 29425 monthly tax. You are given a 15-year bond with a face value of 1500 and it matures in six years.

VPF tax benefits. Visit Section 3 Fringe Benefit Valuation Rules for the valuation rules on vehicle use. The tax benefits of the Voluntary Provident Fund are as follows.

If inclusion of the refund does not change the total tax the refund should not be included in income. Tax benefit rule calculation Monday May 16 2022 Edit. 375 6 years 2250.

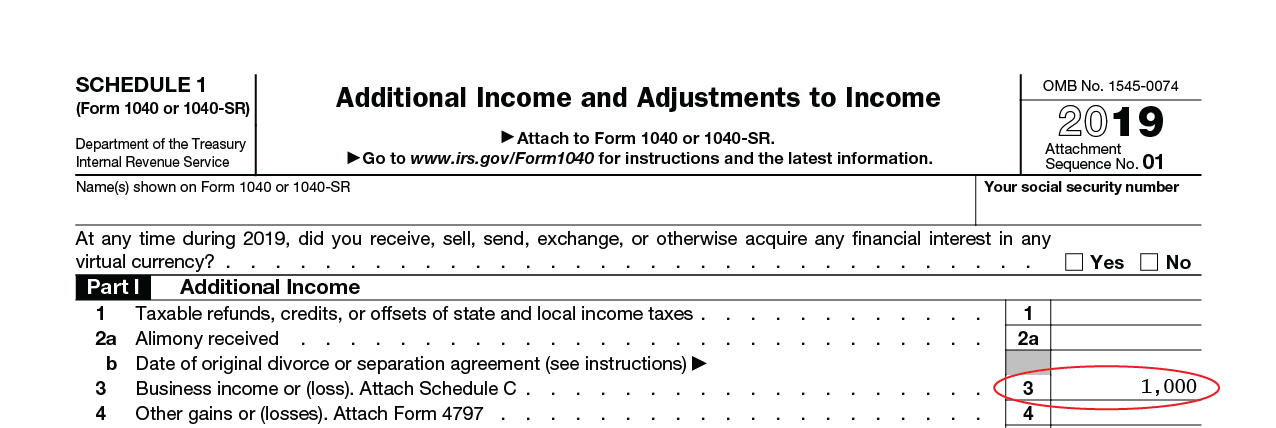

The steps are shown below. The tax benefit rule is often not considered when preparing a Form 1040 yet it takes only minutes to save thousands with it. In general the fair market value of an employer-provided vehicle is the amount the employee would have.

A recalculation of the prior-year federal taxes is. If the couple received a state. A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit.

This amount must be included in the employees wages or reimbursed by the employee. Example of the Tax Benefit Rule. The following examples provide an illustration of the mechanics of the tax benefit rule and how it should work with respect to the new law and the 10000 annual limitation.

The tax benefit rule is a feature of the United States tax system. If using the cents-per-mile rule to value the benefit for the employee you multiply the number of miles the employee uses the vehicle for personal use by the IRS. The calculation would be.

But from 1st January 2022 they can claim nil provisional ITC. When the couple paid the excess refund 400 to the state in the prior year it increased their itemized deduction on their federal return to 14000 from 13600. The tax benefit rule requires Company XYZ to report the 100000 as income on its 2010 tax return and pay taxes on it.

For 2022 the standard. Tax benefits include tax credits tax deductions and tax deferrals. State Local Tax SALT In Rev.

Example with Calculation. The contributions made towards the scheme are eligible for tax deductions under Section 80C. A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the.

2019-11 issued Friday the IRS addressed how the long-standing tax benefit rule interacts with the new 10000 limit on. Jones recovers a 1000 loss that he had written off in his previous years tax.

State And Local Tax Refunds The Tax Benefit Rule Gyf

How To Calculate Earned Income For The Lookback Rule Get It Back

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

50 Real Estate Investing Calculations Cash Flow Irr Value Profit Equity Income Roi Depreciation More Lantrip Michael 9781945627026 Amazon Com Books

Fringe Benefits Tax Australia Wikipedia

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

What Is A Provision For Income Tax And How Do You Calculate It

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Qualified Small Business Stock Qsbs Tax Benefit Carta

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Home Office Tax Deductions Faqs Bench Accounting

Coronavirus Tax Relief Covid 19 Tax Resources Tax Foundation

.png)

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Investment Expenses What S Tax Deductible Charles Schwab

Wash Sale Rule What To Avoid When Selling Your Investments For A Tax Loss Bankrate